how to open tax file in bangladesh

Time limit to submit the return and supporting documents. Choose the online account application form and clicks the link Click here.

Returns To Low Skilled International Migration Evidence From The Bangladesh Malaysia Migration Lottery Program

Now type the code found in the e-tin activation page and click on the Activate button.

. It is a system guided easy-to-use tax preparation software that will save you time money and help you reduce any tax potential audits by the Government. Required Document for Submission of TAX RETURN Document Needed for Submission of TAX RETURN. The government on 7 May 2020 approved draft legislation to extend the time for taxpayers to file their tax returns and to pay their taxes as relief measures in response to the coronavirus COVID-19 pandemic.

You might need to register for new eTIN numbers online. Exchequer through pay order treasury challan or online via. Value-added tax VAT is levied on the importation of goods and the making of taxable supplies in the course of carrying out a taxable activity.

Immediately a message will be sent to your mobile number. File your tax return. Register as a taxpayer.

It is a system guided easy-to-use tax preparation software that will save you time money and help you reduce any tax potential audits by the Government. Update your tax payment. For employees income from salary.

After assessing the amount of income tax every assessee shall deposit the amount to the govt. C if the person is-. In order to obtain a User ID and password to open an account a phone number needs to be provided to the portal.

A copy of the previous years return if you have already submitted the return. Certificate of tax collected at source Doc Certificate of tax collected at source Pdf Certificate of tax deducted at source Doc Certificate of tax deducted at source Pdf Monthly Statement of Tax Deduction from Salaries Pdf. Manage your source tax for withholding agents Interact online with tax support team.

250000 during the income year then that person needs to file. You can calculate yo. In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income.

If you are a withholding agent update your source tax deposit. An individual can follow two procedure to file the return one is universal self assessment procedure and normal procedure. The National Bureau of Revenue NBR of Bangladesh has fastened the process of registering for E-Tin in Bangladesh.

In order to verify a persons status of income. Once you have logged in a list containing all your tax filing obligations is displayed under the Task Overview tab. Configuring Mozilla Firefox and Interner Explorer for Submitting Online Income Tax Return in Bangladesh using Adobe Acrobat Reader DCLatest Adobe Acrobat Re.

Create a User ID by proving necessary informations in the Registration form. Address current and permanent 5. The typical eTIN number is 12 digit and if you had any TIN numbers before.

Tax return filing and tax payment relief. Exchequer by pay order challan treasury or online via wwwnbrepaymentgovbd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned. Tax return filing and tax payment relief measures COVID-19 Bangladesh.

From the homepage Taxpayer clicks Register Account tab. The system displays an online account registration application and Taxpayer saves application form to his computer. First you have to click on the Registrar button then you have to register with the User ID Password Security Question Email Address and Mobile Number.

Primary Information of Assesses. Our taxation services at FM Consulting International ensure both advantage to the individual and compliance according to Bangladesh taxation policy. Supplementary Duty at different rates on.

Return-Business Professional income upto 3 Lakh- IT11CHA. The following is a step by step guidelines on the individual income tax return filing in Bangladesh. For Tax Submission in Bangladesh each assessee shall deposit the amount to the govt after assessing the amount of income tax.

As per the requirement stated in the Finance Act 2017 if any person earned more than Tk. Click Filing under Task OR select the Filing tab and click File a. The National Web Portal of Bangladesh বলদশ is the single window of all information and services for citizens and other stakeholders.

An overview of Individual Income Tax in Bangladesh. The rates of Tax applicable in Bangladesh are as follows. Turnover Tax applicable to turnover tax payer up to Taka 8 million is 3 VAT is not applicable to them.

An individual must file tax return within 30th November with all related supporting documents. A countrys great source of income is its population. Pay your tax online.

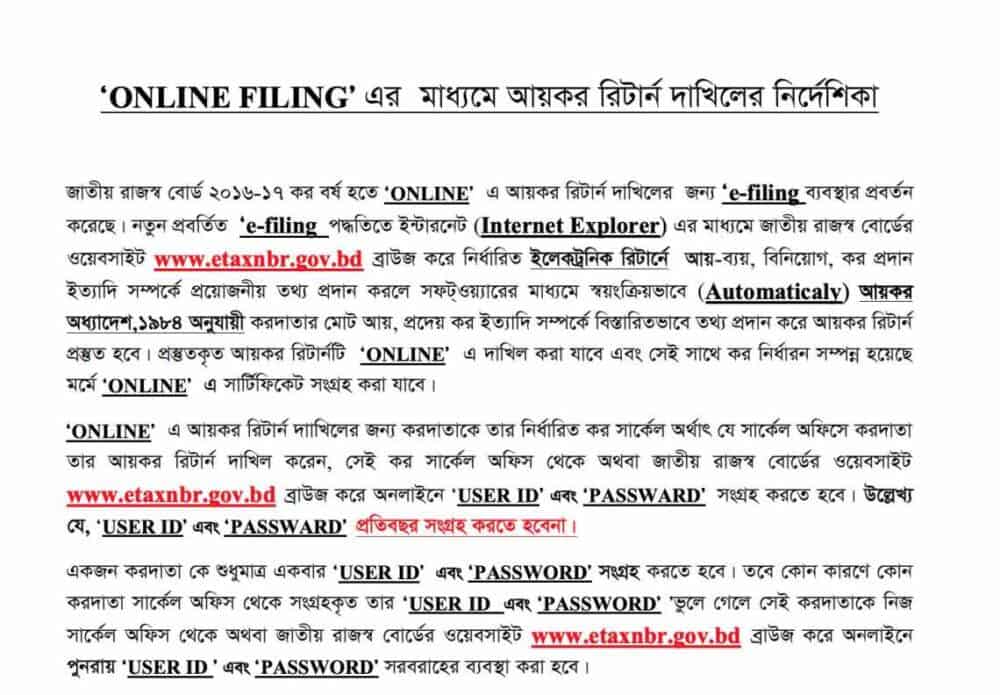

VAT operates in Bangladesh partly as a sales tax. Taxpayer accesses the address httpetaxnbrgovbd. The government earns by levying tax on the income generated by the population.

Now people of Bangladesh can open their eTIN account within just 10-15 from online. Obligation to file tax return. Any non government organization registered with NGO Affairs bureau.

Here the citizens can find all initiatives achievements investments trade and business policies announcements publications statistics and others facts. The standard rate of VAT in Bangladesh is 15. At First Visit the Website httpssecureincometaxgovbdTINHome.

Pictures for the first time. The standard rate is 15 percent. Reduced rates are available depending on the nature of the taxable supply which ranges from 0 percent to15 percent.

B if such person was assessed to tax for any one of the three years immediately preceding that income year. A if the total income of the person during the income year exceeds the minimum tax threshold under this Ordinance. A person shall file a return of income to the DCT of the income year.

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Online E Tin Registration And Income Tax Return 2021 22

Vat On E Commerce Agencies Commissions Only Not Customers

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Advance Income Tax Bangladesh Advance Income Tax On Imports To See Major Overhaul

Nbr Develops E Return Filing Model Nbr Member News Bangladesh Sangbad Sangstha Bss

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

10 Companies Responsible For 40 Of Total Vat In Fy21 Dhaka Tribune

Online Tax Return Application Digitax Launched

What Documents Require With Return Of Income To Nbr In Bangladesh

Call Phone Alcatel Ot 799 3d Model Ad Alcatel Phone Call Model Phone Business Cards Creative Graphic Design Portfolio Print

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Advance Income Tax Bangladesh Advance Income Tax On Imports To See Major Overhaul

Online E Tin Registration And Income Tax Return 2021 22

Bangladesh Tax Return Filing And Tax Payment Relief Kpmg United States